Introduction: Understanding Inflation in 2025

Inflation continues to be a critical economic factor shaping personal finances in 2025. After years of fluctuating rates influenced by global supply chain disruptions, geopolitical tensions, and policy shifts, experts forecast a moderate but persistent inflation trend this year. Understanding how inflation affects your budget and savings is essential to maintaining financial health and achieving your goals.

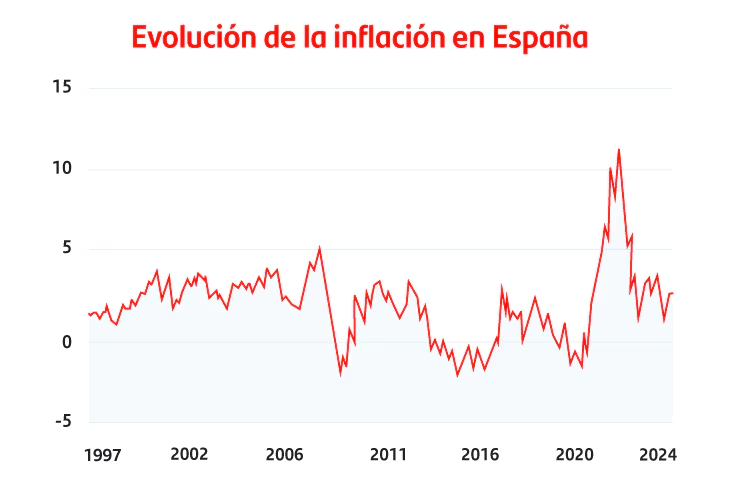

Inflation Outlook for 2025

Economists predict inflation rates will hover around 3-4% in 2025—higher than the historical average of about 2%, but lower than the peak spikes seen in recent years. Key drivers include:

- Rising energy and food prices influenced by climate change and geopolitical events

- Continued supply chain adjustments post-pandemic

- Central banks’ cautious monetary policies aiming to balance growth and inflation control

While inflation is expected to moderate, price increases in essential goods and services will continue to impact households worldwide.

How Inflation Affects Your Budget

1. Cost of Living Increases

Inflation causes the price of everyday items—groceries, fuel, housing, utilities—to rise. This means your monthly expenses may increase even if your income stays the same, putting pressure on your budget.

2. Reduced Purchasing Power

As prices go up, the value of money decreases. A dollar today won’t buy as much tomorrow, which can erode the real value of your savings if not properly managed.

3. Interest Rates and Debt

Central banks may raise interest rates to combat inflation. This can increase the cost of borrowing—higher mortgage, credit card, and loan payments—which affects your disposable income.

Strategies to Protect Your Budget and Savings

1. Adjust Your Budget

Review and update your budget regularly to reflect rising costs. Prioritize essential expenses and identify areas where you can cut back to maintain financial balance.

2. Build an Emergency Fund

Inflation increases uncertainty, making an emergency fund even more crucial. Aim for 3-6 months of living expenses to cushion against unexpected price spikes or income disruptions.

3. Invest in Inflation-Resistant Assets

Consider diversifying your portfolio with assets that historically outpace inflation, such as:

- Stocks: Equities often provide growth that exceeds inflation over the long term.

- Real Estate: Property values and rental income tend to rise with inflation.

- Inflation-Protected Securities: Government bonds like TIPS adjust with inflation.

- Commodities: Investments in energy, metals, or agriculture can serve as a hedge.

4. Increase Income Streams

Explore opportunities for additional income, such as side gigs, freelancing, or upskilling for higher-paying roles to offset inflationary pressures.

5. Reduce High-Interest Debt

Pay down debts with variable or high-interest rates quickly, as these will become costlier if rates rise in response to inflation.

Impact on Long-Term Savings and Retirement

Inflation can erode the future value of your retirement savings if returns don’t keep pace. It’s important to:

- Regularly review your retirement plan assumptions with inflation in mind

- Maximize contributions to tax-advantaged accounts

- Consider annuities or other products that offer inflation protection

Conclusion: Staying Ahead of Inflation in 2025

While inflation in 2025 may not be as severe as recent years, its persistent presence requires proactive financial planning. By understanding its impact on your budget and savings, adjusting your strategies, and investing wisely, you can protect your financial wellbeing and continue moving toward your goals with confidence. Staying informed and adaptable is key to thriving in an inflationary environment.